About this report

This Sustainability Report discloses Downer’s sustainability-related performance for the financial year ended 30 June 2021.

Sustainability performance information relating to Downer entities and joint ventures has been included in the relevant sections of the report.

Changes to the reporting boundaries or measurement methodologies applied with reference to our previous Sustainability Report are addressed in the relevant report sections.

This report discloses the sustainability-related performance of businesses within the Downer Group (Downer EDI Limited) for the financial year ended 30 June 2021. It is to be read in conjunction with Downer’s 2021 Annual Report for information pertaining to the company’s financial sustainability. As such, cross-references to Downer’s Annual Report appear throughout this document.

A message from the

Chairman and CEO

This report has been prepared in accordance with the Global Reporting Initiative (GRI) Standards: Core option, ensuring it presents a full and balanced picture of Downer’s material topics and related impacts, as well as how these impacts are managed.

Sustainability Linked Loan

Downer successfully completed the refinancing of the Group’s debt platform in December 2020, with the establishment of a new $1.4 billion syndicated sustainability linked loan facility.

Sustainability linked loans (SLL) are designed to incentivise borrowers, like Downer, to deliver on commitments to sustainability and to support sustainable economic activity and growth.

The new committed facility comprises three, four, five and six year tranches, and has been structured to enhance the debt maturity profile, reduce average borrowing costs and provide flexibility as the Group continues its program of divesting non-core businesses.

The sustainability aspect of the new facility is underpinned by KPI metrics relating to Downer’s greenhouse gas emissions reductions and social sustainability that, if realised, will lead to a reduction in borrowing costs under the facility. These sustainability KPIs are unique to Downer and reflect the

Group’s continued commitment to its sustainability performance and investment in its people.

The refinancing was the final step in the consolidation of the Group’s debt platforms subsequent to achieving 100 per cent ownership of Spotless on 21 September 2020 and provided an ideal opportunity to align the Group’s financing and sustainability strategies.

The $1.4 billion syndicated sustainability linked loan facility was the largest SLL in Australia in 2020. It was also voted the best in Australia and the Asia Pacific region.

Domestic financial markets publication, KangaNews, awarded Downer the Australian Syndicated Loan Deal of the Year in the annual KangaNews Awards, which polls hundreds of market participants each year to determine the award winners. Asia Pacific Loan Markets Association (APLMA), the industry body that governs bank loan markets in the region, then awarded Downer the Syndicated Green/Sustainable Deal of 2020.

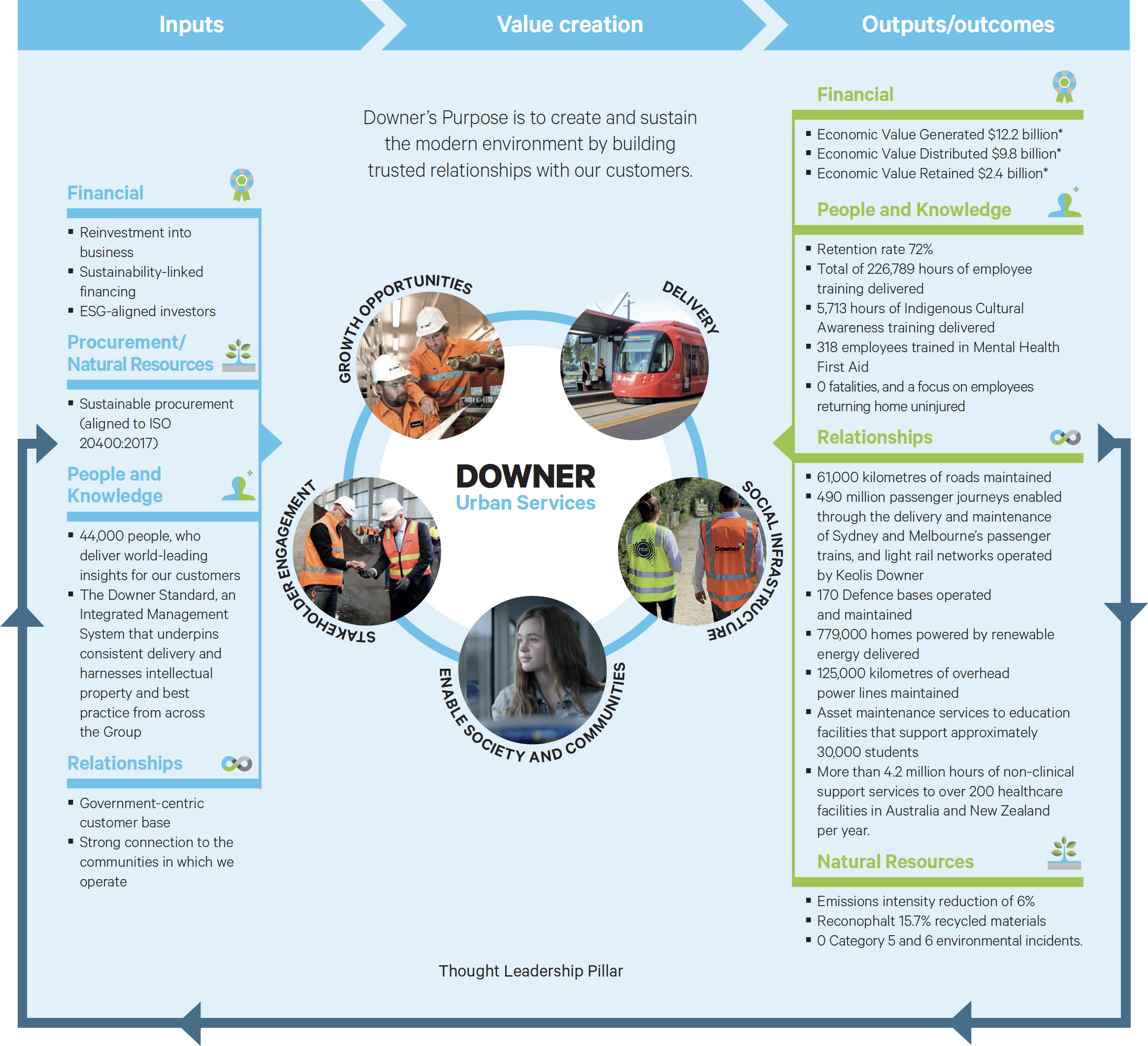

Value chain and value creation

Downer has disclosed its value creation process in line with the concepts of the International Integrated Reporting Council’s (IIRC) six capitals. This shows, at a glance, the interlinkages between Downer’s sources of value (inputs), its business model (value creation), and the value that Downer contributes (outputs).

* Economic Value Generated, Distributed and Retained are GRI-specific metrics, and are not reflective of financial performance in accordance with international or domestic accounting standards.