Climate change and Downer’s TCFD response

TCFD disclosure

Climate change presents a challenge to enhancing liveability, sustaining the modern environment, Downer’s business operations, and the natural environment. While Downer’s business portfolio is diverse, it has limited exposure to the effects of climate change through fixed, long lived capital assets. Downer’s diverse portfolio allows us to be flexible and agile to redeploy assets to high growth areas as markets change. This diversity of portfolio strongly positions Downer to mitigate and manage our exposure to climate risks and to maximise the business opportunities it presents.

Downer accepts the Intergovernmental Panel on Climate Change (IPCC) assessment of the science related to climate change and supports the Paris Agreement in transitioning to net-zero emissions by 2050 to limit global temperature increase to 1.5°C by the end of this century. Downer considers climate change to be one of its material issues.

In FY19, Downer implemented the recommendations of the Taskforce on Climate-related Financial Disclosures (TCFD) in assessing the financial implications of climate change on Downer. In its implementation of the TCFD recommendations, Downer used climate scenario analysis as a key step to understand the resilience of the business under different climatic futures.

Global scenarios were used to inform a top-down assessment of how the physical climate might change, the hazards that our workforce might be exposed to, and how the services Downer provides to key sectors and markets may change. This was particularly important to Downer, as our company Purpose is to create and sustain the modern environment by building trusted relationships with our

customers. The scenario analysis informed strategic planning processes by looking longer-term to critically assess the products and services provided by the business in changing markets.

The scenario analysis was fed directly into Board strategy sessions and to Executive forums, where it remains a permanent consideration of the Board strategy. Further to the scenario analysis outcomes, broader sustainability issues are discussed at Board level. From a tactical perspective, Downer undertakes an annual exercise to test our strategic position on the back of the scenario analysis.

The outcomes of the scenario analysis contributed to a change in the overall strategy of the business. In February 2020, Downer announced it would shift investment in high capital intensive activities to lower intensive and lower carbon activities. Climate change and sustainability were also elevated to retain market share and to secure new customers. This strategic shift will support Downer’s decarbonisation pathway and market position in a low-carbon economy.

The Downer Board, through its oversight functions, has ensured Downer appropriately considers Environmental, Social and Governance (ESG) risks including those related to climate change. In fulfilling this function, the Downer Board also receives oversight from Downer’s Audit and Risk Committee, Zero Harm Committee, Zero Harm Board Committee, Tender Risk Evaluation Committee and Disclosure Committee. Climate-related risks and opportunities are incorporated into Downer’s broader corporate strategy, planning and risk management.

The Downer Board recognises that an integrated approach to managing climate-related risks and opportunities is essential. This has been reflected in the strengthening of Downer’s governance structure and increased focus on climate change in both Board and executive forums.

This has included:

- Formal updates to the Board on a regular basis, and Audit and Risk and Zero Harm Committees on a bi-monthly basis

- Regular updates and stakeholder engagement with the Executive Committee

- Amendments to the Audit and Risk Committee Charter to include explicit reference to climate-related risks and opportunities

- Inclusion of ESG risks and opportunities in the annual Board strategy agenda

- Incorporating ESG risk and opportunity discussions in Divisional executive meetings, including climate-related workshops with senior leadership teams of each Division.

Climate-related risks and opportunities are governed as part of Downer’s Group Risk and Opportunity Management framework and Project Risk Management framework. We identify, manage and disclose material climate-related risks as part of Downer’s standard business practices and in accordance with the Group and Divisional strategies, which apply to everyone at Downer.

The method for measuring the company’s performance is clearly set out in our governance framework, and short-term remuneration incentives are offered to senior managers in relation to the company’s performance against environmental sustainability targets. These targets include the management of critical environmental risks and GHG emissions reduction.

Climate-related risks are governed as part of Downer’s Group Risk and Opportunity Management framework and Project Risk Management framework. We identify, manage and disclose material climate-related risks as part of our standard business practices, which are aligned with our Group and Divisional strategies. This framework applies to all employees, Directors and contractors.

Our Audit and Risk Committee and Tender Risk Evaluation Committee are responsible for providing oversight over Downer’s risk profile, policies and management, and external reporting.

In line with this, we updated the Audit and Risk Committee Charter to explicitly address climate-related risk, given the Audit and Risk Committee’s responsibility for governance and risk management.

To further strengthen our risk management framework in line with the range of impacts and considerations associated with climate risk over the short, medium and long-term horizons, we amended the Consequence Rating Table within the Group Risk and Opportunity Management framework to enable senior management and employees to understand and assess the potential risks and opportunities arising from various future scenarios.

Response to climate-related opportunities

Our existing Group and Divisional strategy process considers key external drivers, as stated above. We have also enhanced our strategy process to incorporate more explicitly climate-related risks and opportunities on an ongoing basis. We have embedded this process in the annual Group strategy session and a similar process into the Divisional strategy sessions.

Outlined above are Downer’s key climate-related risks and opportunities. These risks and opportunities are not listed in order of significance and are not intended to be exhaustive. They represent the most significant risks identified and are informed by a combination of review of Group and service line strategic documents and risk registers, interviews with senior management, and workshops with Divisional leadership teams.

This process confirmed that at present, there are no material short-term climate-related risks for the Group. As indicated above, the majority of Downer’s climate-related risks have been deemed to impact the business in the medium to longer term. Opportunities identified relate primarily to leveraging Downer’s existing capabilities and business model as a service provider to service new and adjacent markets that will continue to emerge as a result of the transition to a low carbon economy.

In FY19 Downer completed scenario analysis to test the resilience of our strategy and the assumptions underpinning the strategic focus areas in relation to the relevant climate futures both physical and transitional. The scenario analysis acknowledges the significant degree of uncertainty associated with how these climate futures will manifest, and explores four different yet inter-related potential futures with varying degrees of climate change severity and alternate socio-economic and political landscapes.

In deciding on the three key issues (and their respective areas of the business) upon which to frame the scenario analysis, Downer undertook a process to identify the future risks and opportunities arising from the transition to a low carbon economy and physical changes and overlay Downer’s strategic priorities, current risks and future changes.

These key areas informed the selection of four divergent, internally consistent and plausible scenarios, based upon the best available literature and modelling. Two of the four selected scenarios explore the minimum plausible global-warming trajectory (holding the world to approximately two degrees of global warming), and to explore the upper limit (approximately four degrees of global warming), with these pairs separated based on the degree to which adaptation is available and practicable in the given future.

The degrees warming is informed by the Representative Concentration Pathways (RCPs) (RCP 2.6 for under two degrees and RCP 8.5 for four degrees), while the transition pathways, including broader energy and socio-economic conditions, are informed by the Shared Socio-economic Pathways (SSPs).

Each of these scenarios provide numeric and qualitative outcomes under which to explore the risks and opportunities. The development of these future scenarios was tailored to Downer’s business strategy by identifying the key risks and opportunities that arose in each of the three selected priority areas. Once these were understood, a key driving climate or transition variable was mapped, enabling consistent exploration of the potential impact or outcome for Downer in each of the four futures.

Key findings include:

- Downer’s strategy was found to be resilient and well positioned in all scenarios used due to the diversification of services across multiple sectors, existing market presence and capabilities

- A <2°C world provides considerable opportunities which outweigh identified risks and will assist with lower cost of capital and increased margins

- Aligning to a <2°C world will require decarbonisation by the second half of the century, with a substantial decrease by 2035.

The scenario analysis work will be used as signposts to inform Downer’s strategy and help Downer to manage some of the uncertainty and complexities associated with these futures. Monitoring government policy (e.g. carbon price), consumer sentiments on climate change, the levelised cost of energy across major energy sources, and the global emission trajectory will provide key insights to best inform Downer’s business strategies.

Downer will continue to focus on a decarbonisation strategy with an emphasis on long-term contracts, technology, energy transition, GHG reductions and efficiencies as well as opportunities to offset emissions.

Physical impacts

In all scenarios weather conditions will become more extreme than today, with extreme rainfall, heatwaves and storms all resulting in potential unsafe work conditions and leading to delays or disruptions in project delivery or operations. More chronic conditions, such as gradual heat rise and longer time in drought, will create a higher risk of dust inhalation and the linked detrimental consequences to worker health.

In the immediate to short-term, these extremes will start to impact the way we perform our activities. Those on the frontline will be our outdoor workforce, who will be at higher risk of both injury and illness in a warming world.

Downer has the opportunity to adapt workplace policies and practices to reduce these risks before they result in consequences to our workforce. These changes will need to be strategically planned to manage the impact on margins. For example, shifting work hours away from daylight hours or implementing policies to stop work on days exceeding extreme temperatures may reduce the amount of time available to complete a project. These factors will therefore need to be a consideration when executing new contracts.

Limiting global warming to under two degrees has relatively more positive outcomes for workforce health, safety and productivity due to a reduction in lost-time, project delays or efficiencies gained, compared to higher warming scenarios.

The transition pathway will also provide opportunities to improve employee safety, with transition away from fossil fuels and internal combustion engines providing opportunities to improve air quality and productivity gains. In each case financial implications will arise due to consequences of lost time, project delays or efficiencies gained.

In all scenarios, resilient infrastructure or adaptation to existing infrastructure will be needed. However, customers are willing to pay a premium for quality sustainable

infrastructure, which may be contracted at higher margins. Points of difference arise across the scenarios in GDP, which will change the focus on critical infrastructure projects and achievable margins.

Downer designs and constructs infrastructure to withstand Australia and New Zealand’s climate. As the climate changes, and in particular extremes heightens, we will need to adjust the design factors and the way we construct infrastructure. Although Downer is already proactively responding to these changes, it will be important to remain aware of the changing future extremes in order to protect our reputation and standing, compared to competitors.

Adapting design and build methods may impact Downer’s margins, so these considerations will need to be carefully priced to assess the merits. For example, while there is still uncertainty in whether the world will limit global warming to two degrees, versus a four-degrees or higher warming, decisions need to be made as to the cost/benefits of incorporating worst-case versus best-case changes into planning. In any event, the climate will change, and the plausible minimum warming will be used as a baseline for decisions.

The sectors in which Downer’s Transport and Infrastructure and New Zealand Divisions operate in will look to protect the resilience of cities as we move towards a warmer world. This provides Downer with opportunities to capitalise on new and emerging markets, particularly in sustainable infrastructure, sea walls, resilient roads and trains, and protection from urban heat islands. The direction of this demand, whether it be sustainable or purely cost-effective adaptation, is still uncertain. However, Downer has the ability to position itself to deliver on these emerging trends based on signposts.

Energy transition (thermal coal transition)

Downer’s Mining business provides mining services across the mining lifecycle, including technical services, drilling and blasting, load and haul, maintenance and mine site rehabilitation. It has a strong reputation for the provision of safe and reliable operational services across a diversified range of commodities.

In FY20, Mining contributed 11.6 per cent of Downer Group’s annual revenue.

The majority of Mining’s contracts are with non-coal customers, however, approximately 50 per cent of Mining’s revenue is generated from coal (thermal and metallurgic) contracts.

At the time of this analysis, the majority of Downer Mining’s coal contracts related to the production of coking coal, with only two contracts involving the production of thermal coal.

The most significant of these contracts is Meandu, which is the third largest contributor to Mining’s revenue. The other relates to Commodore, which is within the top five largest contracts by revenue. The majority of thermal coal produced from both mines is used to supply local power stations in Southeast Queensland – Tarong and Tarong North Power Station (Meandu), and Millmerran (Commodore), with minor quantities sent to export markets.

The International Energy Agency outlook indicates that while thermal coal is declining, it will be part of the global energy mix beyond 2040.

Our Mining business is in a strong market position to capitalise on short to medium-term demand for coal contracting services to meet this energy demand. Although limited growth opportunities exist for thermal coal production in Australia, new growth opportunities are likely to come from overseas.

A strategic issue that may emerge from alternative futures, exploring domestic demand for thermal coal, is the impact on immediate investment decisions. A key consideration is the level of capital required by the business to continue servicing the open cut business.

Downer’s contracts in the domestic thermal coal market are largely short-term. While these contracts can provide uncertainty for the business over the medium to longer term, the short-term nature of the contracts provides the business with flexibility to pivot in response to market changes and customer demands. One of these responses is the demand for alternative metals and minerals. Given Mining’s market presence, reputation and capability, opportunities exist to service emerging minerals and metals commodities.

Another key consideration for our strategy is whether the incremental gain from servicing thermal coal will be outweighed by opportunity costs for the remainder of the Group based on exposure to transitional risks. As reflected in the current increasing stigmatisation of the sector, we see in two scenarios stronger reputation risks, with declining social acceptability and increasing cost of capital, which will apply to the broader Downer Group.

In FY19 Downer acquired the remaining 73 per cent of the Mitsubishi Hitachi Power Systems (MHPS) – Australia and New Zealand Plant Services Pty Ltd business. In conjunction with the share purchase agreement, Downer and MHPS have entered into an Alliance Agreement, which provides Downer with exclusive rights to be the Agent for MHPS in the Australian and New Zealand regions. This has provided Downer with the ability to capitalise on opportunities to provide products and technical services to improve the efficiencies and extend the life of ageing thermal coal generation plants in Australia and overseas.

Changing carbon/energy policy

Globally, the energy transition is occurring at a rapid pace. The energy transition is complex and being driven by multiple, inter-related factors. At a macro level, the costs of energy are changing dramatically driven by technology costs, fuel costs and a shift in consumer preference. Renewables are now viewed by many as the best solution to meet the demand for reliable, affordable and environmentally responsible energy. Energy end-users have increasing options to implement commercially and technologically viable solutions.

In response to the energy transition, Downer and the private sector are actively diversifying products and services, and making investment in new energies. This is driven by focusing on reducing operation costs, positioning for market share in new and emerging markets, and realising competitive advantages.

While energy efficiency has been clearly linked to growing margins, there is also a growing cost advantage in moving towards renewable energy and storage. Embedding energy efficiency and adopting renewable energy and storage technologies are likely to have favourable payback periods,

regardless of whether a carbon price is introduced. Under Sustainability and Follower, where a carbon price is introduced, these technologies provide major cost advantages.

Opportunities to provide higher margin, premium products and services will arise in some scenarios. Improved margins through energy efficiencies and use of renewable technology with storage will deliver swifter payback periods, expedited where a carbon price is introduced.

A rapid transition or a delayed transition, which is out of step with market or consumer expectations, holds implications for Downer’s brand and reputation. Timing is crucial. Moving too slowly will result in increased costs of capital and reduced demand. However, moving too quickly will increase the risk of adopting technology unfit for purpose, impacting service delivery and ultimately brand. An effectively coordinated transition pathway, in line with public expectations, will be the optimum outcome.

Downer acknowledges that climate change mitigation is a shared responsibility. To support the transition to a low-carbon economy in an equitable manner, Downer recognises the need to develop emissions reduction targets that align with the 2015 Paris Agreement goals to pursue efforts to limit the temperature increase to 1.5°C by the end of this century.

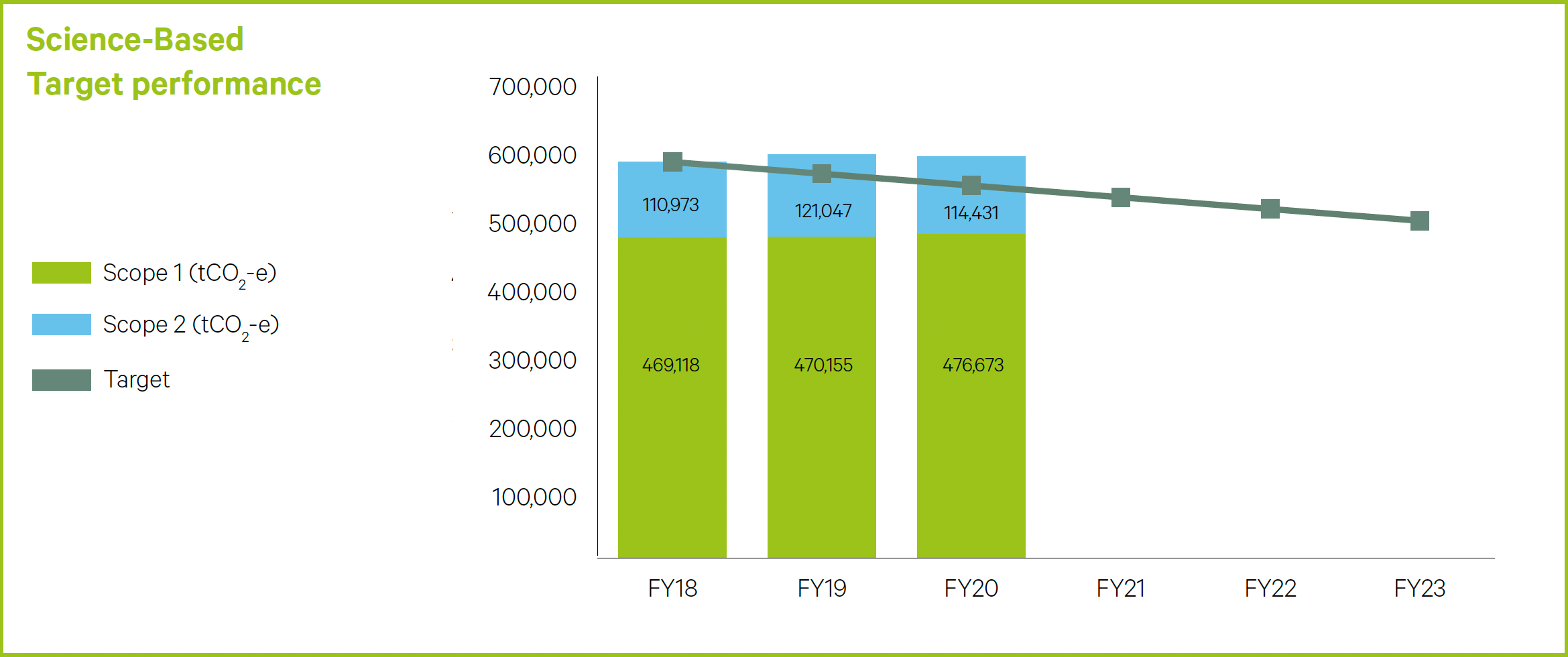

In 2019, we leveraged the Science-Based Target Initiative’s framework and guidance to set an ambitious long-term GHG emissions reduction target (aligned to a 1.5°C pathway). We committed to the decarbonisation of our absolute Scope 1 and 2 GHG emissions by 45-50 per cent by 2035 from a FY18 base year, and to being net zero in the second half of this century.

Downer will track our progress towards these emissions reduction targets and review our emissions reduction approach in line with IPCC’s updated scientific reports, while also considering other developments in low-emissions technology to ensure a practical and affordable transition towards this commitment.

For the purpose of our Science-Based Target (SBT), the boundary is Downer’s Scope 1 and 2 GHG emissions data disclosed in this Sustainability Report, plus the Scope 1 and 2 emissions from our operations at Meandu Mine, which for FY20 accounts for 114,270 tCO2-e Scope 1 and 2 emissions.

Downer holds operational control of Meandu Mine, but has a transfer certificate in place under section 22J of the NGER Act.

Downer’s performance against the SBT was eight per cent higher than the SBT for 2020. The drivers for this, with the exception of the Meandu Mine, are noted in the ‘Managing our GHG emissions’ section. This site is under Downer’s operational control, but not reportable for NGER purposes, as Downer has a reporting transfer certificate in place. Meandu saw a reduction in its emissions footprint for FY20 – contributing to Scope 1 + 2 emissions for SBT purposes being stable for FY20 compared to FY19. When presented on an intensity basis, our assumed SBT performance exceeded target levels. As Downer continues to focus on its Urban Services businesses, the expected economies of scale in being a larger player in a smaller number of sectors should continue to provide benefits from an emissions intensity perspective.

Downer’s pathway to significant decarbonisation is contingent on medium-term to long-term step changes. One of these is the divestment from carbon-intensive businesses, as noted in the TCFD disclosure section. The other key strategy for decarbonisation is the transitioning of fuels that Downer directly combusts to cleaner sources. These changes will have a significant impact on Downer’s carbon footprint. In the interim, Downer continues to make iterative improvements to operations to improve efficiencies where possible, which have a positive impact on emissions as well as costs.

Downer recognises the uncertainties, challenges and opportunities that climate change presents and, despite the impacts of COVID-19, Downer remains committed to partnering with our customers and supply chain to achieve our long-term GHG emissions reduction target.